My Role

Product Designer

Team of 2

Timespan

5 Weeks

Tools

Figma

Delivarable

Desktop Web App

We partnered with Pension Bar to design a retirement planning dashboard combining security and flex accounts—aimed at simplifying complex financial decisions for users.The project was developed for presentation to an undisclosed American company.

About

Project Overview

Due to the sensitivity of the data involved, we are unable to disclose the name of the client, and for reference purposes, we refer to it as "Pensionkasse".

Challenges

1. Flow Complexity

Creating a simple flow for users to follow, involving streamlining the user journey to minimize complexity and maximize clarity.

3. Decision-Making Complexity

Providing users with decision-making tools such as scenario comparisons and retirement income customization.

3. Decision-Making Complexity

Providing users with decision-making tools such as scenario comparisons and retirement income customization

Empathize

Design Concept

We were tasked with creating designs based on the design concept provided by Pension Bar, including three primary pages: "Today's Balance," "Retirement Income," and "Conversion."

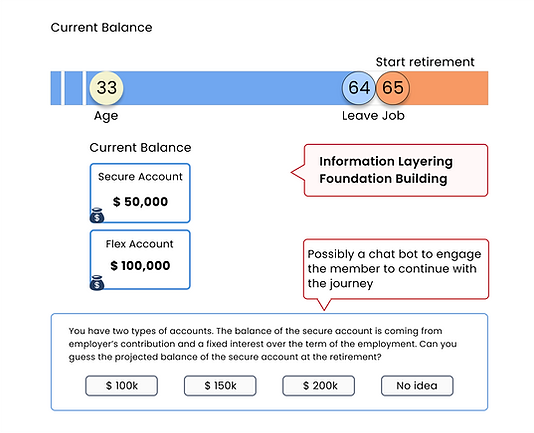

Today's Balance

-

Creates a clear and simple interface to display users' current balances in real-time.

-

Designs the interface with layered information to build a strong foundation for user understanding.

Retirement Income

-

Illustrates the transition from retirement savings to retirement income, in a single page.

-

Employs educational tooltips and information boxes to explain complex financial concepts

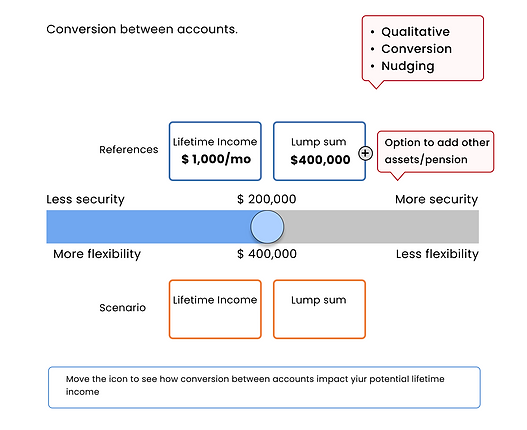

Balance Conversion

-

Enables users to adjust retirement income preferences by converting account balances.

-

Prioritizes user control and flexibility with dynamic sliders and input fields.

-

Provides real-time updates on projected retirement income based on user input.

Define

Persona

Sarah Davis | 35

Overview

Emily, a marketing manager, seeks a user-friendly platform to understand pension options.

Goals

-

Understand pension options: Seeking clarity on available plans, contributions, and benefits.

-

Engage with educational content: Prefers interactive materials to learn about pensions.

-

Plan for the future: Aiming for financial stability and considering working longer for additional benefits.

Pain Points

-

Complexity of pension plans: Finds intricacies confusing and overwhelming.

-

Limited engagement with traditional pension materials: Prefers engaging and interactive presentation of information.

User Flow

The initial user flow outlined below underwent substantial revisions throughout the project lifecycle.

.png)

Develop

Wireframe

.png)

UI Elements Iteration

Certain UI elements, such as sliders, milestone flags, and insight boxes, were iterated multiple times

Insight Box

Slider

.png)

Style Guide

Font choices and visual elements adjusted to align with the client's existing branding.

.png)

Test

User Flow

For the design iterations, we focused on refining five main features of the app, ensuring optimal usability and user engagement:

1

Today's Balance

2

Retirement Balance

3

Balance Conversion

4

Leaving Job Early

5

Scenario Comparison

Initial flow

In the initial flow, Today's Balance and Retirement were consolidated onto a single page. This approach proved problematic as the flow became lengthy for users and overwhelming amount of information presented at once..

Today's Balance + Retirement Balance

Balance Conversion

Leaving Job Ealy

Scenario Comparison

Iteration #1

Primary Flow

Today's Balance

Retirement Balance

Balance Conversion

Optional Flow

Leaving Job Ealy

Scenario Comparison

Today's Balance and Retirement were separated, and advanced functions like Leaving Job Early and Scenario Comparison became optional. Although this iteration improved user experience however the client highlighted that the Conversion page was rarely used by early-career users.

Iteration #2

Primary Flow

Retirement Balance

Today's Balance

Optional Flow

Leaving Job Ealy

Scenario Comparison

Balance Conversion

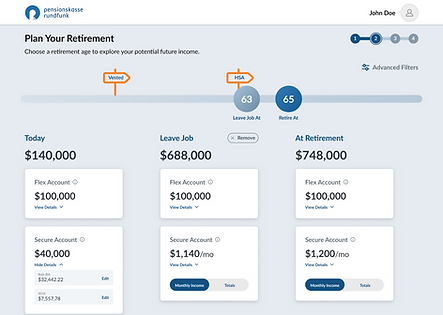

The final flow streamlined the process by prioritizing Today's Balance and Retirement Balance, followed by Account Summary/Next Step. Optional flows were easily accessible. This approach enhanced user flexibility and control over their retirement journey.

Today's Balance

Simplified layout focused on key numbers, with real-time updates and sliders for adjusting retirement age.

Initial Design

Final Design

Retirement Balance

Revised the layout to horizontal, opting to prominently display retirement income on this page instead of leaving job early. We also enhanced clarity by incorporating icons and colors, while adjusting element sizes.

Initial Design

Final Design

.png)

Balance Conversion

The initial slider lacking precision and clarity. Additionally, we introduced consistent icons for improved visual coherence and expanded the accompanying text to enhance user comprehension of the conversion process.

Initial Design

Final Design

Leaving Job Early

Leaving job early has its own dedicated page instead of only a section. Additionally, it now includes a comparison feature, illustrating how much the user will receive at a specific time compared to their retirement income.

Initial Design

.png)

Final Design

Hand-off page

In the final design, users can access comprehensive features like Balance Conversion, Leaving Job, and Scenario Comparison to view updated results. Additionally, they have the option to access their portal for further actions.

Initial Design

Final Design

.png)

Design

Checking Balances

Upon app onboarding, the journey begins with today's balance, followed by retirement savings.

Users can adjust the age slider to instantly visualize retirement savings and income.

Depending on the selected age, users unlock benefits. For instance, retiring after 60 entitles users to medical benefits.

Balance Conversion

Balance conversion is a feature within the advanced function menu, enabling users to customize the lump sum and income they receive at retirement.

Users can view their projected retirement balances for both income and lump sum options.

User can adjust the slider to tilt towards either more security or more flexibility to observe the corresponding changes instantly.

.png)

Leaving Job Early

Based on data, approximately 30% of users opt to leave their jobs earlier than retirement age to access funds.

Upon selecting a departure date using the slider, they can see their balance at the early departure date.

Also, user can see how their balances change if it stays in the plan till retirement.

Scenario Comparison

Users can compare various scenarios, including retirement income, retirement balance, or the balance upon leaving a job.

users can compare scenarios by viewing and analyzing a base scenario along with up to three different ones.

Users have the option to download or save the data within the app's account summary.

In Summary

Task

The task involved designing a retirement planning dashboard for Pension Bar, integrating security and flex accounts to enhance retirement security and flexibility.

Approach

Created wireframes, refining them based on feedback and usability testing. Continuous iteration ensured alignment with project goals

Product

The final product is a user-friendly retirement planning dashboard featuring Today's Balance, Retirement Projection, Account Summary, Conversion Page, Leave Job, and Scenario Comparison.